- Blotter Weekly

- Posts

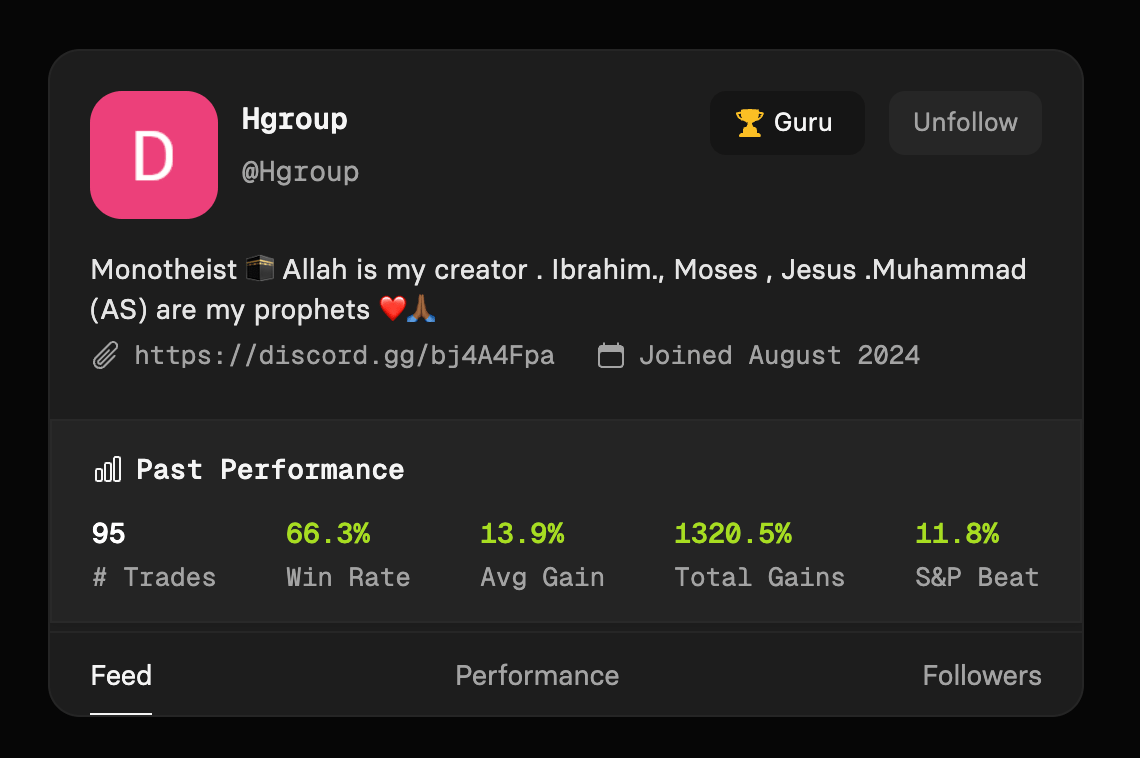

- Our top pro beat S&P by 35% this week

Our top pro beat S&P by 35% this week

SPY +0.44% vs HGroup +36%!

Leading Pro of the week!

@HGroup: This week had a blast and so did our members who copied him. With 13 out of 16 trades in last day significantly in the green he closed the week with average gains of +36%. Here is a quick view of his trades for the week.

Trade | Hold Time | Profit / Loss | Day Bought |

|---|---|---|---|

15 min | + 55% | Tuesday | |

16 min | + 76% | Tuesday | |

6 min | + 72% | Wednesday | |

37 min | + 62% | Wednesday | |

57 min | + 44% | Wednesday | |

2 Days | - 100% | Wednesday | |

1 Day | + 76% | Thursday | |

1 Day | + 20% | Thursday | |

13 min | + 60% | Thursday | |

33 min | + 46% | Friday | |

24 min | + 16% | Friday | |

19 min | + 60% | Friday | |

3 hours | - 40% | Friday | |

40 min | +64% | Friday | |

34 min | + 84% | Friday | |

- | - 7% | Friday |

Discord Community!

As you browse the app, some times you would have questions on the exit strategy or want more details on the hypothesis. Our community is pretty active and always ready to help out. Shoutout again to @HGroup who provided detailed charts for all his trades and patiently answered all the questions.

Download Android (or iOS) App

No need to keep the browser tab always open to see when your Pro exits their position. Download the app, follow some top pros and enable notifications. Make sure to review the app on Google Play / App store. If you have any feedback or features that you want to see in the app, simply reply to this email and it will go straight to our founders.

Last Week’s Market Reaction

S&P 500 saw a mixed performance. The index remained largely stable despite some choppy trading, as strong economic data, particularly the jobs report, supported investor sentiment. The U.S. labor market showed surprising strength, with September's Nonfarm Payrolls exceeding expectations, which helped offset concerns about inflation and rising interest rates. Manufacturing data remained in contraction, but overall, the market remained resilient, reflecting a soft-to-no-landing scenario for the U.S. economy.

Next Week’s Market Outlook

Several key events could impact the market, particularly the Consumer Price Index (CPI) and Producer Price Index (PPI) reports, which are crucial for gauging inflation trends. The Q3 earnings season will also kick off, with major financial institutions like JPMorgan and Wells Fargo reporting their results. These factors, along with ongoing geopolitical risks and the Federal Reserve's stance on interest rates, will shape market movements. The outlook for the week leans "slightly bullish," though much depends on how these key reports are interpreted by investors