- Blotter Weekly

- Posts

- 10+ traders beat S&P this week & Android app launched!

10+ traders beat S&P this week & Android app launched!

Copy Trades on the go!

Top 10 Pros on Blotter!

S&P Beat: We created this metric to find the select few people out of the crowds who can actually beat the market. We monitor every Pro’s performance and compare it to SPY movement during the same time period to calculate S&P Beat numbers.

Make sure to follow all 10 of these and stay up to date on their next trade.

Profile | Winrate | S&P Beat | Best Trade |

|---|---|---|---|

90% | +5% | ||

75% | +11.2% | ||

73% | +5% | ||

71% | +14.4% | ||

64% | +22.4% | ||

67% | +64.4% | ||

62% | +10.4% | ||

63% | +7.6% | ||

56% | +11% | ||

54% | +12.4% |

Download Android (or iOS) App

No need to keep the browser tab always open to see when your Pro exits their position. Download the app, follow some top pros and enable notifications. Make sure to review the app on Google Play / App store. If you have any feedback or features that you want to see in the app, simply reply to this email and it will go straight to our founders.

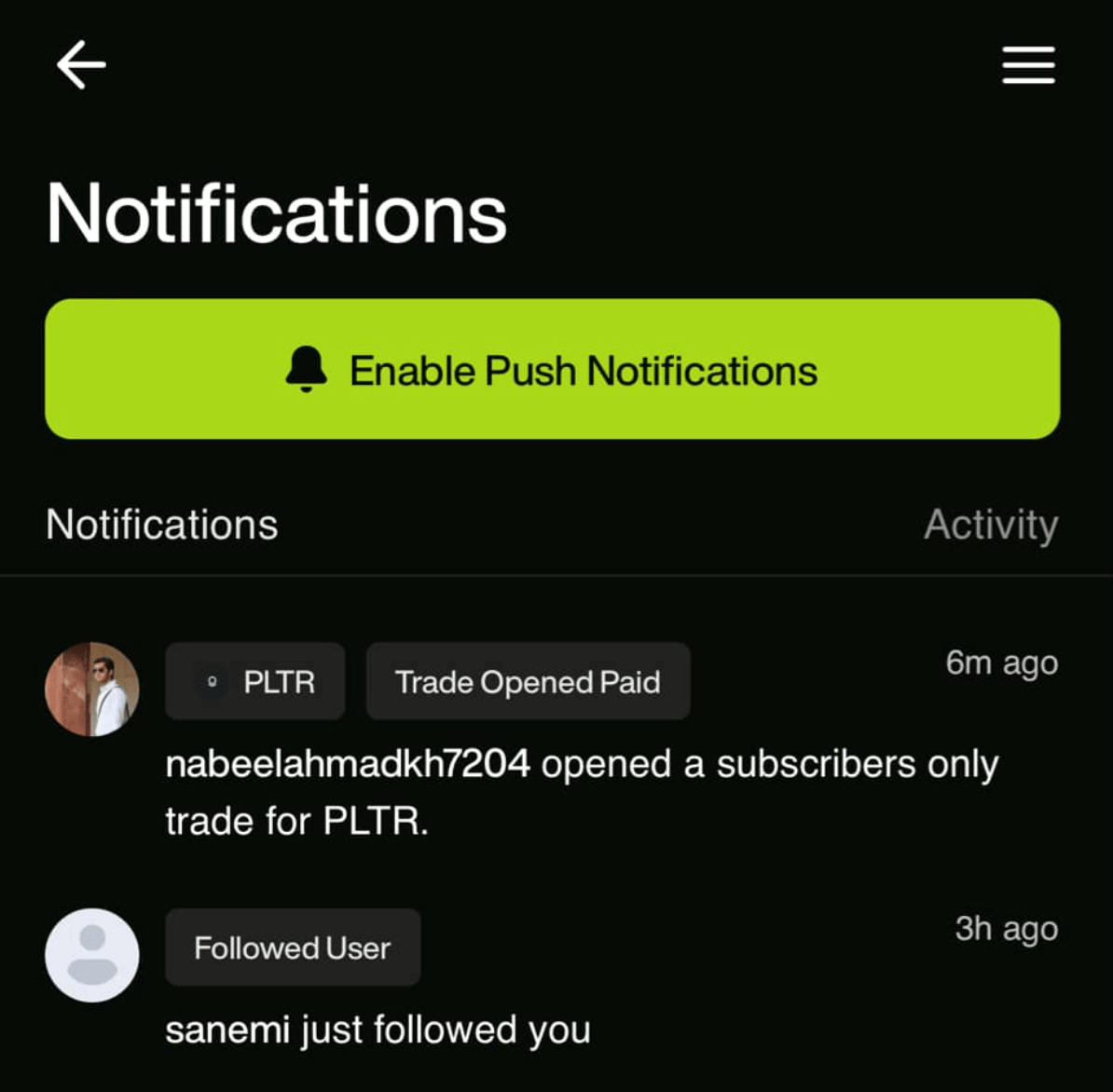

Power of Notifications

Markets move quickly, specially around key events. Your chances of making big profits go down the later you jump in on the trend. Make sure to turn the turn the app notifications on and get alerted of your Pro’s next move from in realtime! Find this shortcut to turn them on from the bell icon on top right in the app.

Top Trade of the Week!

Last Week’s Market Reaction

Last week, the markets saw continued growth, driven primarily by positive economic data and a 50-basis-point interest rate cut by the Federal Reserve. The S&P 500 gained 0.62%, while the Dow Jones closed at a record high, rising 0.59%.

China’s stock market saw a notable surge last week. This rise was driven primarily by policy moves from the Chinese government aimed at boosting economic growth, including stimulus measures and hints at further interest rate cuts. BABA led the charge with a +10% jump on Wednesday. (Shoutout to @karma who got us all in for some BABA calls on Tuesday)

Gold continued its upward trend, posting its third consecutive month of gains, Silver posted impressive 2.3% gains and Bitcoin showed signs of recovery, rising 3.5% last week

Next Week’s Market Outlook

Looking ahead to next week, key reports, including the nonfarm payrolls and ISM manufacturing data, could introduce volatility, especially as these metrics have previously triggered market fluctuations. Despite these risks, the market's positive momentum may continue, particularly as investor sentiment remains buoyed by expectations for further interest rate cuts.

Additionally, earnings from major retailers like Nike and Levi Strauss will provide insights into consumer demand, which remains a crucial pillar of economic growth. Investors should remain cautious of stretched equity valuations and upcoming political uncertainties as the U.S. election draws nearer